Notice how the market had broken above resistance intraday, but on the daily time frame this break simply appears as a wick. The 4-hour chart above illustrates why we need to trade this on the daily time frame.

However, by applying the rules and concepts above, these breakouts can be quite lucrative. As you can see, there is no “one size fits all” when it comes to trading rising and falling wedges. Like the strategies and patterns we trade, there are certain confluence factorsthat must be respected. The illustration below shows the characteristics of a falling wedge.

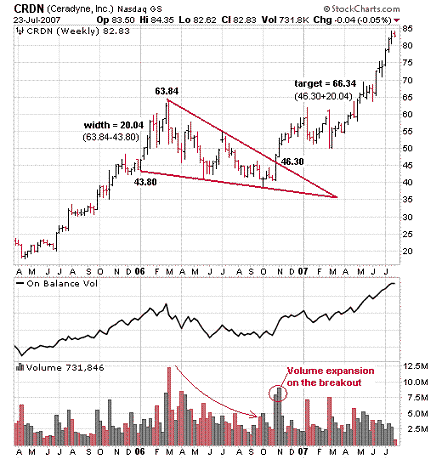

Put simply, waiting for a retest of the broken level will give you a more favorable risk to reward ratio. Although the illustrations above show more of a rounded retest, there are many times when the retest of the broken level will occur immediately following the break. See the lesson on the head and shoulders pattern as well as the inverse head and shoulders for detailed instruction. They can also be part of a continuation pattern but not matter what it’s always considered bullish. Falling wedge patterns are wide at the top and contract to form the point as price moves lower. There can sometimes be a correction to test the newfound support level just to make sure it holds and is a valid breakout. Once resistance is broken, that level now becomes support. But the key point to note is that the upward moves are getting shorter each time. How Can I Automatically Identify RisingĪfter all, each successive peak and trough is higher than the last. Since there are many potential ways to trade wedges, some may use a trailing stop-loss, small stop-loss, large stop-loss, small profit target or large profit target. A trader’s success with wedges will vary depending on their win rate, risk-management controls and risk/reward over many wedge trades. Read our complete guide to stock chart patterns for more information. Simpler patterns include wedges and triangles, whereas more complex patterns include head and shoulders, rounded bottoms and tops, and double and triple tops/bottoms. There is a wide range of trading patterns that you can trade. Top 3 Continuation Patterns All Traders Should Know It is formed by the descending resistance line and the horizontal support level. This is the chart pattern continuing a downtrend, though it may sometimes execute against the trend. As a result, some starts to sell and take profits, which pushes the price lower.Ī profit is locked after growth to the size of the H base. As the price rises, it reaches a point where bulls start raising doubts about how high it can go. The chart below shows the stock price of Beyond Meat, a popular company that is disrupting the meat industry.

Wedges are a common continuation and reversal pattern that tend to occur in many financial markets such as stocks, forex, commodities, indices and treasuries. During intra-day trading, it may only take a few hours for a falling wedge to form. When you’re looking at charts you’ll notice it can even take up to 6 months to form. In other words, if the bear wedge is formed during an uptrend, chances are, that the uptrend will continue after the completion of the wedge. Then we see a sort of paradoxical event that is singular to the falling wedge – falling but consolidating price action. Notice the climax and spike higher that preceded the sharp drop.

FALLING WEDGE PATTERN HOW TO

This is whylearning how to draw key support and resistance levels is so important, regardless of the pattern or strategy you are trading. The break of this wedge eventually lead to a massive loss of more than 3,000 pips for the most heavily-traded currency pair.

0 kommentar(er)

0 kommentar(er)